Frequently Asked Questions

Why should I consider hiring a public adjusting firm?

Attempting to re-establish normalcy after a loss can be very time-consuming. The demands of preparing a claim to comply with the requirements of your policy are a full-time job, even for the experienced professionals. The experts at Insurance Adjusters Group relieve you of the claim responsibilities allowing you to devote your time and energies to the resumption of normal activities.

How can public insurance adjusters help?

The first step following a property loss is policy review to determine if the loss (peril) is covered under the terms of the policy and what limitations and exclusions there are. Insurance Adjusters Group can help with the review of your policy to ascertain what coverages you may have under the policy. Second, in order to sustain a successful claim with your insurance company, the burden of proof of damages is on you, the insured. Insurance Adjusters Group will prepare a comprehensive, detailed loss claim to ensure you receive a fair and equitable settlement.

When should I consider hiring a public adjusting firm?

Immediately. The most common mistake we see is an insured compromising his or her position because they waited to hire Insurance Adjusters Group. Too often, we are retained after the insured has already committed to a partial settlement or after irreparable harm is done to settling the loss. The initial steps you take will have a profound impact on the ultimate outcome of your claim.

What should I look for in a public insurance adjusting firm?

Experience, expertise, professionalism and integrity are the most essential ingredients. Your public insurance claims adjuster should have experience handling the type of claim you have and employ its own dedicated staff of adjusters and appraisers, inventory specialists and certified public accountants (able to handle sophisticated business income losses), if applicable.

What problems might I encounter if I try to adjust the claim myself?

All claims are subject to differences of opinion. They are not black and white. Typically, disagreements arise concerning what is covered and what is excluded, the scope of damages, restoration required, applicable depreciation and labor and material costs. Remember, the burden of proof is upon you, the policyholder, to prove your damages.

Why not just rely on my insurance agent to help adjust the loss?

Insurance agents are experts at selling insurance. They do not have the specialized knowledge required to appraise and prepare claims. That is why insurance companies rely on adjusters, not agents, to settle claims.

What information will be required to prove my claim?

Your documentation must include all or part of the following:

- Detailed unit cost appraisal to replace building damage

- Detailed physical inventory and appraisal of all furniture, fixtures, equipment and stock

- Insurable value appraisal for any co-insurance requirements

- Identification and evaluation of your insurable interest in any of the betterments and improvements

- Physical depreciation schedules for all property

- Determination of salvage disposal

- Analysis of income loss for any business interruption claim

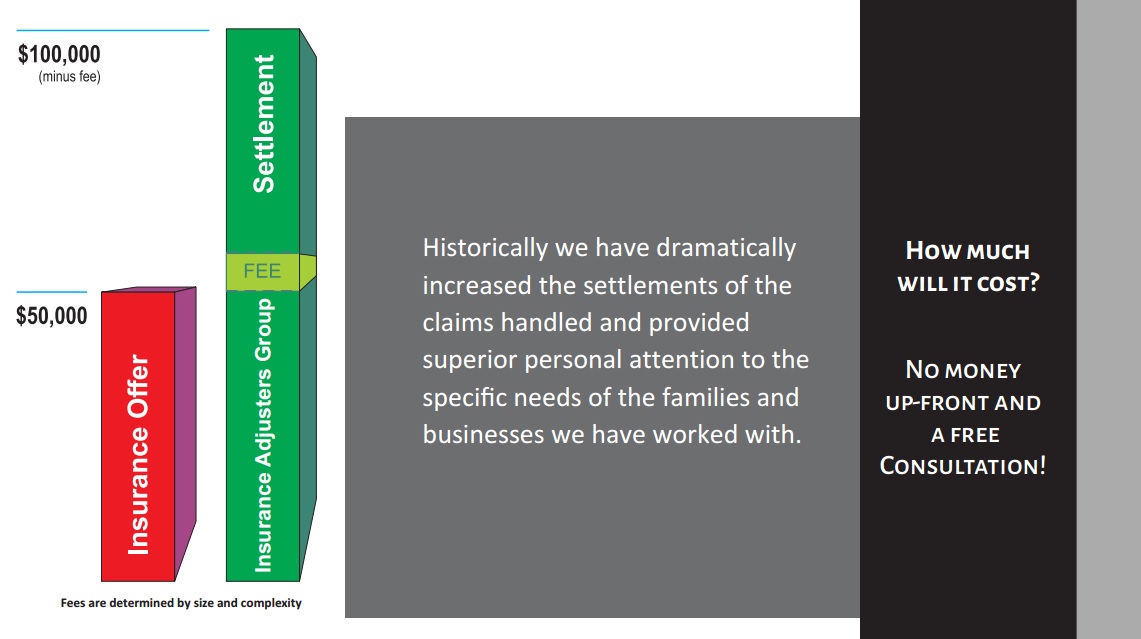

How does a public adjuster get paid?

Usually, our fee is a small percentage of the settlement. Our past clients have found that the services provided by Insurance Adjusters Group have been financially beneficial and our fees absorbed as a result of our involvement.